Medicare Supplement Plans

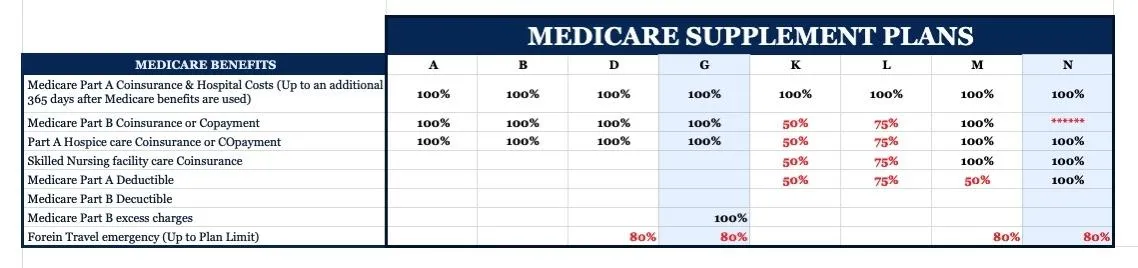

Medicare Supplement Plans have been around since Medicare first was signed into law in the 1960’s. Insurance companies looking at Medicare saw an opportunity to cover risk, and thus Medicare Supplements were born. In 1992 the plans were standardized into the structure we have today. When you hear Medicare Supplement Plans, think Plan G, or Plan N.

Imagine a Medicare Supplement Plan like a swimming pool. There are many companies that offer a Plan N or a Plan G in the state. Each pool, whether it’s a Plan G 'pool' or a Plan N 'pool', is identical in its medical benefits from insurance company to insurance company. The difference is in the monthly premium, or the rate you pay every month while you’re in the pool. Medicare Supplement Plans often have an annual rate increase for everyone in the pool and a birthday rate increase. You want to pick a company that has a big swimming pool, with lots of people in the pool, as well as a company with a proven track record of steady consistent rate increases. Think:

More People in the 'Pool' + Bigger 'Pool' = More Expected Steady Annual Increase

or

Less People in the 'Pool' + Smaller 'Pool' = Potentially Higher/Erratic Annual Increase

You may wonder, 'Do I qualify for a Medicare Supplement Plan?' The answer depends on your circumstances. Turning 65 or enrolling in Part B after 65 grants you an 'Open Enrollment Period' to join any plan without underwriting. If you're outside this period or don't have a special circumstance, changing Medicare Supplement Plans may require passing underwriting. With Basin Benefits, our experienced advisors can guide you through the process, helping you find the perfect plan to meet your needs.